Ingersoll Rand Will Spin Off Its Commercial And Residential Security Businesses

Breaking News: Ingersoll Rand Will Spin Off Its Commercial And Residential Security Businesses

Ingersoll-Rand plc today announced that its Board of Directors has unanimously approved a plan to spin off its commercial and residential security businesses (the “new security” company). The separation will result in two standalone companies: Ingersoll Rand, a world leader in creating comfortable, sustainable and efficient environments through its industrial, transport refrigeration, and heating, ventilation and air conditioning (HVAC) businesses; and the new security company, a leading global provider of electronic and mechanical security products and services, delivering comprehensive solutions to commercial and residential customers. Ingersoll Rand expects the spin-off, which is intended to be tax free to shareholders, to be completed in approximately 12 months.

Ingersoll-Rand plc today announced that its Board of Directors has unanimously approved a plan to spin off its commercial and residential security businesses (the “new security” company). The separation will result in two standalone companies: Ingersoll Rand, a world leader in creating comfortable, sustainable and efficient environments through its industrial, transport refrigeration, and heating, ventilation and air conditioning (HVAC) businesses; and the new security company, a leading global provider of electronic and mechanical security products and services, delivering comprehensive solutions to commercial and residential customers. Ingersoll Rand expects the spin-off, which is intended to be tax free to shareholders, to be completed in approximately 12 months. “Given the distinct strengths and strategies of the two proposed companies, the Board believes that this structure will enable investors to value our different businesses separately, creating value for both companies and their shareholders,” said Michael W. Lamach, Ingersoll Rand’s chairman and chief executive officer. “We believe the spin-off, which is the result of an in-depth review of strategic alternatives by our Board and management, will allow both companies to enhance value by allocating capital and deploying resources in a more focused way, while preserving and increasing synergies within their businesses. At the same time, it will position the new security company to build scale and make the necessary investments for the future.

“Given the distinct strengths and strategies of the two proposed companies, the Board believes that this structure will enable investors to value our different businesses separately, creating value for both companies and their shareholders,” said Michael W. Lamach, Ingersoll Rand’s chairman and chief executive officer. “We believe the spin-off, which is the result of an in-depth review of strategic alternatives by our Board and management, will allow both companies to enhance value by allocating capital and deploying resources in a more focused way, while preserving and increasing synergies within their businesses. At the same time, it will position the new security company to build scale and make the necessary investments for the future.

“The new proposed standalone companies will leverage leading market positions, well-known brands and experienced people. We believe both companies will be well positioned to better execute their respective strategic plans to capitalize on future market opportunities, serve customers, create sustainable growth, and enhance shareholder value,” said Lamach, who will continue after the spin-off to serve in his current role as Ingersoll Rand’s chairman and chief executive officer.

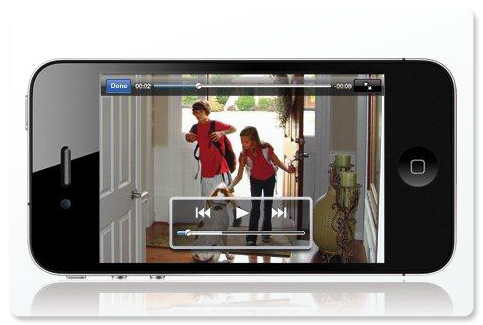

Under the plan, Ingersoll Rand’s existing commercial security business (currently known as the Security Technologies sector) will be combined with its residential security business (currently part of the Residential Solutions sector) to form a leading global safety product and services provider. This new company’s portfolio of brands will include Schlage, LCN, Von Duprin, Interflex, CISA, Briton, Bricard, BOCOM Systems, Dexter, Kryptonite, Falcon and Fusion Hardware Group.

The new company will have annualized revenue of approximately $2 billion on a pro forma basis based on 2011 revenues. The new security company is expected to generate strong free-cash flow and have the financial flexibility to take advantage of future growth opportunities.

The new security company is also expected to have strong margins, as well as strong brand recognition and market-leading products and solutions, to set a solid foundation for future growth. The company will benefit from synergies in sourcing, technology, and assembly operations across the residential and commercial security markets. It also will have the opportunity to invest in key markets to take advantage of growing trends around increased security concerns, electronics connectivity, product life-cycle costs and rapid demand growth in emerging markets.

Execution of the transaction requires further work on structure, management, governance and other significant matters. Management is developing detailed plans for the Board’s further consideration and approval. The leadership team of the new security company will be announced prior to the completion of the spin-off. Upon completion of the spin-off, Ingersoll-Rand plc will cease to have any ownership interest in the new security company, and the new security company will become an independent publicly traded company. The new security company is anticipated to be an Irish plc.

The completion of the spin-off is subject to certain customary conditions, including receipt of regulatory approvals, receipt of a ruling from the U.S. Internal Revenue Service as to the tax-free nature of the spin-off, as well as certain other matters relating to the spin-off, receipt of legal opinions, execution of intercompany agreements, effectiveness of appropriate filings with the U.S. Securities and Exchange Commission, and final approval of the transactions contemplated by the spin-off, as may be required under Irish law. The company noted that there can be no assurance that any separation transaction will ultimately occur, or, if one does occur, its terms or timing.

Comments

Post a Comment