Analytics Rings Up More Retail Sales

When loss prevention directors first brought security video into their

stores, an initial aim was to deter shoplifters or, if that failed, use the

recorded video to make the shoplifter agree to restitution, or to fight slip and

falls.

When loss prevention directors first brought security video into their

stores, an initial aim was to deter shoplifters or, if that failed, use the

recorded video to make the shoplifter agree to restitution, or to fight slip and

falls.

Times started changing when security started realizing that much of the

shrink was from sales associates, thanks in part to sources such as the National

Retail Security Survey and the National Retail Federation (NRF). So some cameras

turned to cash register stations, backrooms, loading docks and back doors. When

the economy went south, some loss prevention executives and law enforcement

officers believed that shoplifting would increase substantially as compared to

internal theft, since there are fewer associates employed and those remaining

not wanting to take a chance on losing their jobs.

The doomsday scenario seems not to have happened in retail crime and even

more generally. As severe economic pressures slowly subside, retailers are

noticing the same slight movement in merchandise losses and other types of

criminal activity in their stores, according to NRF. There’s always an emerging

threat or two: Organized retail crime seems to be today’s growing danger. And

some retailers see increasing problems with counterfeit goods, ranging from

pills to purses, sneaking onto shelves through the supply chain.

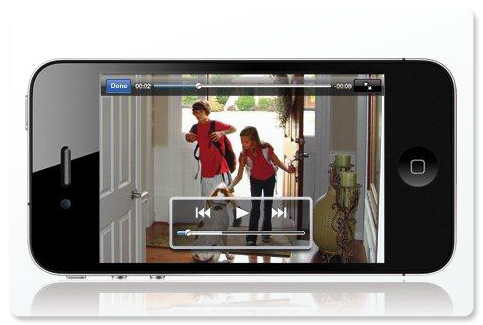

During these retail ups and downs, rights and lefts, security video itself

has grown up with more cameras installed inside and out, a noticeable shift to

IP, video integrated into other security and business systems and more

intelligence at the edge and more analytics.

No doubt, the technology has gotten better, more accurate. But the mightiest

surprise is how fast and in how many diverse ways security video analytics has

become a key tool of merchandising executives, for those positioning stock on

the store floor or on shelves, to help determine specials and promotions aimed

at a certain demographic, to name just a few. Video analytics can tie to public

view monitors hanging from a store ceiling or digital signage devices over which

a retailer can even sell interactive advertising.

Attraction to Customized Services

In a recent survey of 100 retail security managers, research firm Frost &

Sullivan found that managers are very much aware of the importance of creating

solutions well-tailored to their specific operational and security requirements.

Matia Grossi, research manager for physical security group and author of the

survey, notes “The majority of retailers, when asked about unmet needs, points

out that customized services, innovative technology and the integration of old

and new security systems are all value-added services that retailers are

starting to expect from their system integrators.” Among trends identified: the

ability to monitor and analyze from one central location, says Grossi.

In a recent survey of 100 retail security managers, research firm Frost &

Sullivan found that managers are very much aware of the importance of creating

solutions well-tailored to their specific operational and security requirements.

Matia Grossi, research manager for physical security group and author of the

survey, notes “The majority of retailers, when asked about unmet needs, points

out that customized services, innovative technology and the integration of old

and new security systems are all value-added services that retailers are

starting to expect from their system integrators.” Among trends identified: the

ability to monitor and analyze from one central location, says Grossi.

“More than 70 percent of those we interviewed declared an awareness of the

utility of video surveillance for applications beyond pure security, such as

customer counting and demographic and queue monitoring, with varying percentages

for each application. Roughly 80 percent of those aware of this possibility

suggested they are also looking actively into the potential deployment of video

analytics,” Grossi adds. While the research points out that no analytics works

perfectly, there is growing interest in collecting more demographics that

differentiate among a man or woman, race, and age. In these applications, since

they are not security-centric, accuracy is less of a problem. Getting more

information automatically can prove helpful on the merchandise and marketing

sides.

This evolution of video analytics, cutting across the entire business,

mirrors the evolution of the loss prevention profession itself. And it is an

example to follow for enterprise security leaders in other types of

business.

Tim Fisher, director, asset protection and safety for Best Buy, points out

that “I have watched the loss prevention industry evolve throughout the course

of my career. When I first started in the profession, [it] barely consisted of

more than the corporate cop. We were focused very specifically on enforcing

company rules and catching violators. For many of us, our worth was measured by

apprehension statistics.

Tim Fisher, director, asset protection and safety for Best Buy, points out

that “I have watched the loss prevention industry evolve throughout the course

of my career. When I first started in the profession, [it] barely consisted of

more than the corporate cop. We were focused very specifically on enforcing

company rules and catching violators. For many of us, our worth was measured by

apprehension statistics.

Loss Prevention Focus Sharpens

“In my early days, there wasn’t even much focus or discussion on actual

shrink rates,” Fisher adds. “Somewhere in the late 1980s and early 1990s, as

loss prevention-related technology evolved and became affordable and more

user-friendly, it seemed as though everyone rushed to implement technology

solutions to shrink.”

These days, at giant chains such as Best Buy and even at small boutique

stores, analytics has help break through the silos and, as a corollary, brought

loss prevention executives even closer to their businesses.

It started as an experiment a couple of years ago when Best Buy brought in

technology from Verint Systems on a 45-camera platform in one of its 45,000

square foot stores to help analyze and optimize customer experiences associated

with product placement and promotions.

Mirroring Fisher’s experience over the years, Jim Shepherd, retail national

account manager at Protection One, says that loss prevention has taken on a

proactive role both for security and for the business side. Integration overall

is another trend with alarms, security video and access control among the

elements, he says. And it’s economy driven, he notes. It’s ROI. Analytics can

help with under-rings and sweethearting. And more often today, the marketing

folks are networked into the video side, he says. Some analytics such as facial

recognition are still not there, he says.

Concerning integration, Bill Taylor, president of Panasonic System Networks

Company of America notes that video and data can be integrated with other

applications such as retail systems, human resources, process management and

access control systems. Smarter cameras on the edge of the network can identify

objects left behind (for security) or help track customer traffic patterns,

crowd counting, etc., for non-security applications. Face recognition can

certainly serve a security function, but it could also be used to identify a

retail store’s best customers, for example, to alert employees to provide VIP

treatment.

Concerning integration, Bill Taylor, president of Panasonic System Networks

Company of America notes that video and data can be integrated with other

applications such as retail systems, human resources, process management and

access control systems. Smarter cameras on the edge of the network can identify

objects left behind (for security) or help track customer traffic patterns,

crowd counting, etc., for non-security applications. Face recognition can

certainly serve a security function, but it could also be used to identify a

retail store’s best customers, for example, to alert employees to provide VIP

treatment. Such new-age tools go beyond security to help retailers understand shopper

behaviors and trends by providing insight into in-store promotions and

advertising campaigns, identifying traffic flow patterns and measuring

dwell-time, and helping to ensure proper product placement on shelves and

aisles. By using a video analytics tool, retailers can extract and search

customer behaviors through stored video. In addition, the analysis can be used

along with point-of-purchase (POS) data to further understand buying

patterns.

Such new-age tools go beyond security to help retailers understand shopper

behaviors and trends by providing insight into in-store promotions and

advertising campaigns, identifying traffic flow patterns and measuring

dwell-time, and helping to ensure proper product placement on shelves and

aisles. By using a video analytics tool, retailers can extract and search

customer behaviors through stored video. In addition, the analysis can be used

along with point-of-purchase (POS) data to further understand buying

patterns.

At the time of the initial startup, Best Buy’s Fisher said, “Within hours of

the installation, store management was working actively with the solution and

modifying product placement based on the information.”

Of course, analytics is not the only tool in security’s bag.

Some simple kinds of analytics such as motion detection have been around for

many years. But according to Brendan Daly of Eye P Video, there are advantages

with network-based video and with digital video storage and retrieval: analytics

works well inside and in fixed environments. Daly’s bottom line is that digital

turns video into data which a retailer can mine for a variety of security and

business reasons.

There are indications that loss prevention executives are close to pulling

the IP video trigger. At NRF’s Big Show early in January, a Surveillance

Survey Report, conducted by the Loss Prevention Research Council (LPRC) and

sponsored by Axis Communications, found that 87 percent of retail companies who

currently use analog technology for surveillance are now considering migration

strategies toward network video.

Almost all of the retailers surveyed (98 percent) claimed to currently use

video surveillance in their stores, yet just 25 percent stated that they have

already made the move to an all IP-based surveillance system. There is also a

push to megapixel and high definition cameras with “at the edge” analytics

processing and storage, which demands networking. Such advanced installations

can offer intelligence ranging from simple people counting to more sophisticated

applications.

Simple people counting can, however, be useful to a number of businesses.

Gaming establishments may employ this video analytic in conjunction with state

regulation to determine taxes based on patron visits. More typical retail

operations often embed people counting into their video upgrades and

analog-to-digital migrations. Intelligent tracking is another feature of video

analytics. It can track how customers look at items or if they just passing

through. It can tell you if they are touching items on the shelves or, for

security needs, if the customer is taking too many items.

For instance, a number of shopping centers, owned and managed by Canada’s

Ivanhoe Cambridge, are deploying new IP video surveillance systems. Mapleview

Shopping Centre, located in Burlington, Ontario, is the latest to undergo the

transformation, following a successful installation at the company’s Mayfair

Mall in Victoria, British Columbia. Santo Polito, property services manager for

Ivanhoe Cambridge, explains that shopping center management can access footage

to help analyze events, promotions and footfall trends. Real-time analytics can

also be used for some innovative applications. Mapleview is currently trialing

the directional virtual tripwire analytics function built into the video

transmitter modules to provide the shopping center with a count of customers

entering two of the building’s entrances. This provides better accuracy than

so-called “Eye-Beam” equipment installed on the doorways, which unfortunately

can double-count people as they enter and leave the premises.

For instance, a number of shopping centers, owned and managed by Canada’s

Ivanhoe Cambridge, are deploying new IP video surveillance systems. Mapleview

Shopping Centre, located in Burlington, Ontario, is the latest to undergo the

transformation, following a successful installation at the company’s Mayfair

Mall in Victoria, British Columbia. Santo Polito, property services manager for

Ivanhoe Cambridge, explains that shopping center management can access footage

to help analyze events, promotions and footfall trends. Real-time analytics can

also be used for some innovative applications. Mapleview is currently trialing

the directional virtual tripwire analytics function built into the video

transmitter modules to provide the shopping center with a count of customers

entering two of the building’s entrances. This provides better accuracy than

so-called “Eye-Beam” equipment installed on the doorways, which unfortunately

can double-count people as they enter and leave the premises.

Business Intelligence Adds Value

Video can be a theft deterrent, contends Dr. Alan Lipton, chief technology

officer, Lenel/UTC Fire & Security, but it becomes even more valuable when

you add analytics into the business processes and business intelligence needs,

he says. For security alone, loss prevention seeking higher level technology

must overcome pricing hurdles, especially when many retail operations run on

thin profit margins. But, according to Dr. Lipton, when you add analytics to the

business intelligence side, such as buying patterns or POS, the business side

often can share the buy with security. Analytics continues to improve and itself

diversify into various approaches. Maybe, one day, retail will use even more

sophisticated ways for video to alert to potential theft in real-time. For

example, he suggests that infrared (thermal) video can increase the accuracy of

facial recognition; and algorithms, at the heart of analytics, may one day alert

to change in blood flow in the face of a potential shoplifter, excited about

stealing goods.

Beyond security, says Russ Tate of ADT Security Services, security video and

analytics is all about the customer experience. One interesting twist is the

emergence of enhanced public view monitors (EPVM) that can sit on a shelf next

to or near high ticket or high risk goods. The monitors can be at eye level and

can come with a built in video recorder. In addition to alerting to suspicious

actions, “they can drive addition revenue. Just stick in a flash player and at

certain intervals, it provides audio and video promotion, which the product

maker or distributor would compensate the retailer similar to prime shelf

position or other store displays.

In addition to the allure of digital video, for some retailers analytics has

been so attractive that new types of businesses have started up to take security

video from a client store, analyze it and provide back or give access to reports

that can be easily customized by specific security and business needs. The data

often go way beyond simple people counting.

POS Working With Analytics

One of these firms, Agilence, specializes in POS video auditing with a

mixture of software and analysis services that enables retailers to quickly

identify losses caused by operational errors, promotion execution, systemic

errors, and associate fraud. While the firm works with loss prevention, it

markets clearly to a retailer’s COO, CFO and CIO by appealing to their need for

return on investment beyond security. Rite Aid, the large drugstore chain, uses

the professional auditing services at nearly 600 of its stores. “The software

nicely complements our existing loss prevention initiatives,” says Robert

Oberosler, Rite Aid group vice president.

Another firm, Retel Technologies, blends machine vision and cloud computing

with a trained human auditor workforce. Video is usually captured on-site,

encoded and transmitted to the firm’s secure servers for proactive auditing,

which determines what video to send into human auditing. The service also

creates video auditing tasks to distribute to the auditing workforce and

monitors the workforce to accept or reject auditors’ work based on quality and

accuracy.

|

Face It: Smart Cameras Work the

Infrastructure Better

There are current and emerging “gee-wiz” security video and analytics

applications. Where the technology resides can make a difference.Video cameras are offering more on-board intelligence, which enables additional and more effective smart functions to happen at the edge of the network, says Bill Taylor of Panasonic System Networks Company of America. Smarter cameras help minimize the system’s computational load and the amount of data that travels across the network, which makes for better use of network infrastructure, he says. Some of the more interesting technologies that have applications even beyond security include face matching, sophisticated video motion detection, objects left behind and virtual tripwires in video images. Smart video-based face detection and matching can identify known shoplifters as they enter a store, even if there are several people in the frame, Taylor notes. Used together with cameras providing on-board face detection, network video recorders with embedded face matching capability eliminate the use and added expense of external software. |

Comments

Post a Comment