Middle East shifting from analog to IP-based video surveillance

Middle East shifting from analog to IP-based video surveillance, says IMS Research

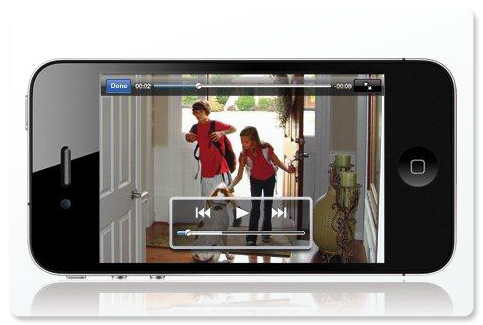

| Monitoring video in Saudi Arabia |

The previous edition of the Middle East Market for CCTV and Video Surveillance Equipment, which was published in 2010, forecast that the tipping point would not take place until 2012. However, market analyst and report author, Oliver Philippou, says, “With less impact from the 2008 economic slowdown than expected due to the conservative nature of the Islamic banking system and an increase in global oil demands, many regions of the Middle East have continued to see massive infrastructure projects. This has led to an acceleration in the transition from analog to network video surveillance technologies.”

Philippou continues: “With some countries, including Turkey, still predominantly installing analogue equipment, this transition is just getting started. Network video surveillance equipment is forecast to account for 79% of network and analogue video surveillance equipment sales in the Middle East by 2016.”

The Middle Eastern market will be driven by strong demand for video surveillance equipment in the larger regional markets, IMS continues. Turkey, the largest market in the Middle East, is still mainly serviced by analog equipment. However, due to a number of infrastructure and transportation projects, the penetration of network video in Turkey will increase significantly towards 2016.

In Iran, a heavy focus on city surveillance will be the key driver. In Saudi Arabia, large infrastructure projects in hospitals, schools, and airports will drive network video surveillance penetration. These projects are due to a surplus of oil revenues and a response to uprisings across the Arab world.

Large banking projects have also been confirmed in Kuwait for 2012 and 2013, while the construction industry in the UAE is expected to see improvements towards 2015 and 2016, notes IMS.

While the Middle East is not the first region to tip in favor of network video surveillance, it is one of the first outside of Western Europe and North America to do so

Comments

Post a Comment