IP - The Future is Here, You Just Have to Find It

The Future is Here, You Just Have to Find It

Network video has come a long way. Almost two decades have passed since the world’s first network camera was launched. Back in the mid-90s, we wouldn’t have anticipated some of the installations in operation today. From transportation and city surveillance to bank and retail applications, network-based digital surveillance continues to live up to its great potential, and new applications are opening up even more exciting possibilities for the future.

Network video has come a long way. Almost two decades have passed since the world’s first network camera was launched. Back in the mid-90s, we wouldn’t have anticipated some of the installations in operation today. From transportation and city surveillance to bank and retail applications, network-based digital surveillance continues to live up to its great potential, and new applications are opening up even more exciting possibilities for the future.

I wanted to share some of our technology visions and the IP video trends we see shaping up in the near future. What might some of the most forward looking real-world security installations look like five years from now?

In the Cities

One of the toughest surveillance challenges in cities boils down to one question: Do you know what’s going on in your city right now? City surveillance covers traffic problems, personal and property safety, crime deterrence and crowd control. Lower Manhattan’s“Ring of Steel” is an example of how law enforcement, public agencies and private businesses can pool together resources to fight crime when using networked video. In places like the southwest of Holland and Toronto, IP cameras at critical factories handling hazardous items, such as refineries and other chemical plants, are connected to the cities’ monitoring centers. Having such an infrastructure can save a lot of lives if a disaster were to happen. City surveillance cameras are often used by the police, monitoring them live, in addition to laptops in cruisers. Smartphones and tablets have made tremendous enhancements, leading to higher demands on the cameras. They must provide images that are as clear and detailed at night as they are during the day. An example of this is the ability of IP cameras to now see color even when it is dark—called Lightfinder technology—something that analog could never do.

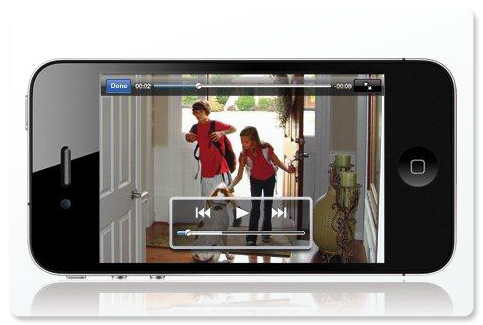

One of the toughest surveillance challenges in cities boils down to one question: Do you know what’s going on in your city right now? City surveillance covers traffic problems, personal and property safety, crime deterrence and crowd control. Lower Manhattan’s“Ring of Steel” is an example of how law enforcement, public agencies and private businesses can pool together resources to fight crime when using networked video. In places like the southwest of Holland and Toronto, IP cameras at critical factories handling hazardous items, such as refineries and other chemical plants, are connected to the cities’ monitoring centers. Having such an infrastructure can save a lot of lives if a disaster were to happen. City surveillance cameras are often used by the police, monitoring them live, in addition to laptops in cruisers. Smartphones and tablets have made tremendous enhancements, leading to higher demands on the cameras. They must provide images that are as clear and detailed at night as they are during the day. An example of this is the ability of IP cameras to now see color even when it is dark—called Lightfinder technology—something that analog could never do.

Critical needs like these also affect the user’s total cost of ownership. It is important that network cameras in essential places are reliable and rugged. As installation costs are often higher than the cost of the cameras themselves, purchasing high quality cameras with limited maintenance pays off in the long run. For instance, easily integrate-able thermal IP cameras have now made their way into cities as an affordable long-term detection option and are no longer restricted to military or super critical applications.

Technologies, such as thermal and color- at-night Lightfinder, will progress significantly in city surveillance usage over the next five years, but other hot trends may take a bit longer. Edge storage is one. IP cameras with edge storage can be used today to augment a city system and cover areas where bandwidth is limited, but the vast deployments will require larger amounts of memory than we have today, though Moore’s Law will help us get there sooner than some might think.

Technologies, such as thermal and color- at-night Lightfinder, will progress significantly in city surveillance usage over the next five years, but other hot trends may take a bit longer. Edge storage is one. IP cameras with edge storage can be used today to augment a city system and cover areas where bandwidth is limited, but the vast deployments will require larger amounts of memory than we have today, though Moore’s Law will help us get there sooner than some might think.

Proactive Surveillance in Public Transport

Transport is also an important part of city life, but presents its own unique challenges. Stations and transit systems are exposed to a number of security incidents every day, ranging from vandalism and graffiti to pick-pocketing and violence. A traditional, analog surveillance solution is mainly used forensically to investigate incidents after they have occurred. In a network-based solution, the video should play a more crucial role, offering new possibilities for efficient monitoring and responding to real-time incidents.

A huge number of IP cameras have been successfully installed on buses, trains, in stations, terminals and depots in different parts of the world. Madrid, Moscow, Oslo, Prague, Stockholm and Sydney have network video solutions installed in their transit systems. The Sydney airport was the first major airport in the world to install networked video and continues to add network cameras by the day, proving what we said all along about the scalability benefits of IP.

Page 2 of 3

Today, most airports have realized the lower cost of ownership they get from network cameras, and here the market has gone away from analog. Instead of a couple hundred analog cameras covering an entire airport five years ago, that same airport may have thousands of IP cameras today. On top of the sheer increase of eyes on the scene, there are new applications emerging beyond the typical centralized camera management.

Think of cameras at security checkpoints. For instance, the operators can immediately identify if someone takes the wrong bag, phone or wallet. Digital cameras with intelligent analytics are able to count people and luggage to better manage traffic flow, like what’s being done at Saint Exupéry Airport in Lyon, France. With the ability to watch live video from security cameras at any location, decision making, prioritization and response becomes much more efficient. Here the demands on the cameras are similar to those of city surveillance. After all, a transportation network is part of the community.

Think of cameras at security checkpoints. For instance, the operators can immediately identify if someone takes the wrong bag, phone or wallet. Digital cameras with intelligent analytics are able to count people and luggage to better manage traffic flow, like what’s being done at Saint Exupéry Airport in Lyon, France. With the ability to watch live video from security cameras at any location, decision making, prioritization and response becomes much more efficient. Here the demands on the cameras are similar to those of city surveillance. After all, a transportation network is part of the community. Cash is King

Cash is KingWithin our cities, some might argue—or at least believe privately—that the most important buildings are the ones housing cash. Banks were among the first institutions to install surveillance cameras back in the 1970s to deter crime. However, crime has evolved since then to where not only bank robberies are a threat, but also ATM-related fraud is on the rise.

Unfortunately, the development of surveillance equipment used in banks has not kept the same pace as crime. It is a vertical that still employs analog. Fortunately, we see this as one of the major growth markets for networked video.

One of the challenges for bank surveillance is image quality. As banks traditionally have a lot of glass windows and polished, marbled floors causing reflections and backlight situations, the image quality needs to be excellent in varying light conditions. The surveillance system also needs to be reliable. Out of 5,000 U.S. robberies in 2011, less than one camera was activated and actually functioning per robbery, suggesting outdated systems. Properly configured network-based surveillance systems, on the other hand, would be augmented with an active-tampering alarm so the cameras/encoders can tell the security team if the video view is blocked, out of focus or if there is no signal at all before an incident takes place. We see several examples of financial institutes around the world now renewing their systems for these reasons, such as Banco do Nordeste in Brazil or Liberty Life in South Africa.

One of the challenges for bank surveillance is image quality. As banks traditionally have a lot of glass windows and polished, marbled floors causing reflections and backlight situations, the image quality needs to be excellent in varying light conditions. The surveillance system also needs to be reliable. Out of 5,000 U.S. robberies in 2011, less than one camera was activated and actually functioning per robbery, suggesting outdated systems. Properly configured network-based surveillance systems, on the other hand, would be augmented with an active-tampering alarm so the cameras/encoders can tell the security team if the video view is blocked, out of focus or if there is no signal at all before an incident takes place. We see several examples of financial institutes around the world now renewing their systems for these reasons, such as Banco do Nordeste in Brazil or Liberty Life in South Africa. Another area that will grow is ATM surveillance with the possibility to use IP video capabilities to more efficiently combat fraud. ATM manufacturers are constantly investing in research and development for new anti-skimming devices. The combination with networked video will be one way of improving the anti-fraud solutions. This is an efficient way of retrofitting ATMs with modern, digital HDTV-quality surveillance equipment—even pinhole-sized, all-digital covert cameras—combined with different applications for combatting fraud.

Another area that will grow is ATM surveillance with the possibility to use IP video capabilities to more efficiently combat fraud. ATM manufacturers are constantly investing in research and development for new anti-skimming devices. The combination with networked video will be one way of improving the anti-fraud solutions. This is an efficient way of retrofitting ATMs with modern, digital HDTV-quality surveillance equipment—even pinhole-sized, all-digital covert cameras—combined with different applications for combatting fraud.Beyond Loss Prevention in Stores

Speaking of ATMs, retail stores likely house the highest number of cash machines outside of banks. This market will be another area of massive growth for network video, thanks in large part to video analytics that offer a range benefits beyond increased security.

In both retail operations and on the sales floor, competition is fierce and profit margins are slim. Retailers have to seize every opportunity. This often means adopting the latest technological advances. That’s why nearly every aspect of retail operations, from inventory to hiring, is computerized and networked. Many retailers have added video surveillance to this list of going digital.

In 2011, the total video surveillance market hit $10.5 billion. By 2016, IMS Research estimates the same market to reach $20.5 billion. The market specifically for retail security video—analog and digital—is around 25 percent of the total surveillance market. Yet, less than 35 percent of retailers use IP video, making retail a major factor in IP growth and opportunity.

Loss prevention is the main motivator for cameras but other aspects are now getting more focus. In the United States, slip-and-fall related accidents cost a lot of money and justify spending on higher-quality cameras. Once these higher-quality network cameras are in place, there are many other things retailers can do to turn the cameras from a cost into a revenue generator. Think of the ability to do accurate people counting and heat mapping as a way of increasing the top line. Video data gathered from the store floor can be used to negotiate better rates with product vendors. Customer service and store efficiency will also see a boon. Lacoste and Neck & Neck stores in Spain have already found the secret to intelligence for operational efficiency in retail, and analytics will evolve to play a major role in stores over the next five years.

In spite of the recession, there has been an increase in business-related applications and an increased interest in moving from analog to network/IP video. Through the use of video analytics, retailers can not only prevent loss by monitoring their stores, customers and staff, but they also have a valuable business intelligence tool at hand. This solution has cross-functional appeal in providing business intelligence for marketing, merchandizing, operations and PoS. The cost of the system can be spread across a number of company divisions.

In spite of the recession, there has been an increase in business-related applications and an increased interest in moving from analog to network/IP video. Through the use of video analytics, retailers can not only prevent loss by monitoring their stores, customers and staff, but they also have a valuable business intelligence tool at hand. This solution has cross-functional appeal in providing business intelligence for marketing, merchandizing, operations and PoS. The cost of the system can be spread across a number of company divisions. Retailers’ use of applications is mainly loss prevention-based, but there are many indicators that this will change. As retailers continue to expand usage of security applications, they will add business applications. A recent survey* states that more than one-half of retailers are aware of hot/cold zones/ heat map applications and may use them in the future. More than two-fifths of retailers have said they may analyze dwell time in the future. This is only the beginning.

Retailers’ use of applications is mainly loss prevention-based, but there are many indicators that this will change. As retailers continue to expand usage of security applications, they will add business applications. A recent survey* states that more than one-half of retailers are aware of hot/cold zones/ heat map applications and may use them in the future. More than two-fifths of retailers have said they may analyze dwell time in the future. This is only the beginning.

Smaller stores—independent or organized as a chain/franchise—will take longer to evolve since it’s where analog technology has its largest stronghold. But IP is going to transform this market during the coming years with edgebased storage and hosted video.

When hosted video is combined with edge recording, bandwidth will no longer be a limiting factor for as-a-service video solutions. Since edge-based storage takes away the need of a DVR, we will hopefully see a major shift away from analog. In five to 10 years, most cameras will come preconfigured with recording and will operate on its own, out of the box, which will be perfect for small installs. Of course, you will need high-quality software to operate the system in all levels, from an entrylevel basic view/record solution to an enterprise-sized one where thousands of retail outlets are connected.

Let’s not forget those retailers that have existing analog CCTV. They can expand the system in the near term using video encoders to create a hybrid system, and there is no need to fully replace the old equipment in order to take advantage of the benefits of network video.

Five Years Ahead, Today

Much of the advancements in IP video surveillance over the next five years are being successfully deployed in small pockets around the world today. To make this vision come true for all, we have a big job in educating the market of all the possibilities that network video brings because the ecosystem evolves daily. Keep your eyes, ears and minds open to learn from those colleagues who have already installed innovative solutions and are five years ahead today.

TAHNK YOU U for so informative blog vist us for CCTV bus solutions in dubai

ReplyDelete