How an Investment in Security Can Prevent Unplanned Expenses

How an Investment in Security Can Prevent Unplanned Expenses

Unplanned expenses can be a major financial burden, especially for businesses. A single incident of theft or vandalism can cost thousands of dollars in repairs, lost productivity, and legal fees. However, by investing in security, businesses can significantly reduce their risk of these types of incidents.

There are many different types of security measures that businesses can take, such as:

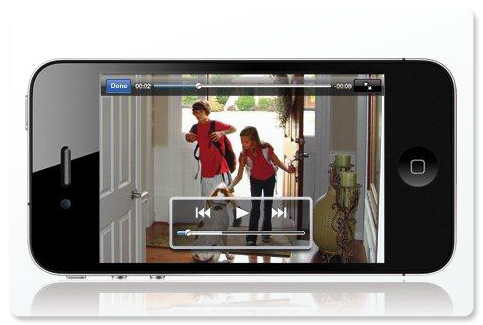

- Physical security measures: These include things like security cameras, fencing, and access control systems. Physical security measures can help to deter criminals and prevent them from gaining access to your property.

- Cybersecurity measures: These include things like firewalls, antivirus software, and data encryption. Cybersecurity measures can help to protect your computer systems and data from unauthorized access.

- Employee training: It is important to train your employees on how to identify and report suspicious activity. Employee training can help to prevent incidents before they happen.

The cost of investing in security can vary depending on the size and type of business. However, the benefits of security far outweigh the costs. By investing in security, businesses can protect their assets, reduce their risk of liability, and improve their bottom line.

In addition to preventing unplanned expenses, there are other benefits to investing in security. For example, security can:

- Improve employee morale: Employees who feel safe and secure are more likely to be productive.

- Attract and retain customers: Customers are more likely to do business with businesses that they feel are secure.

- Protect your reputation: A security breach can damage your reputation and make it difficult to attract new customers.

Overall, investing in security is a wise decision for businesses of all sizes. By taking steps to protect your property, data, and employees, you can help to prevent unplanned expenses and improve your bottom line.

How to deal with unplanned expenses

If an unplanned expense does occur, there are a few things you can do to manage it:

- Find ways to stretch your budget. This may mean cutting back on unnecessary expenses or finding ways to increase your income.

- Consider new borrowing options. If you need to borrow money to cover the expense, there are a variety of options available, such as credit cards, personal loans, or lines of credit.

- Be cautious about liquidating investments. Selling investments can be a quick way to get cash, but it's important to weigh the pros and cons before doing so.

- Get your emergency savings ready for next time. An emergency fund is a great way to cover unexpected expenses so that you don't have to rely on credit or other borrowing options.

By taking these steps, you can minimize the financial impact of an unplanned expense and get back on track financially.

Conclusion

An investment in security can help businesses to prevent unplanned expenses and improve their bottom line. By taking steps to protect your property, data, and employees, you can reduce your risk of theft, vandalism, and other security breaches. In addition, security can improve employee morale, attract and retain customers, and protect your reputation. If an unplanned expense does occur, there are a few things you can do to manage it, such as finding ways to stretch your budget, considering new borrowing options, and getting your emergency savings ready for next time.

Comments

Post a Comment